Deciding whether to buy a home now or wait can feel overwhelming. With factors like Omaha’s current real estate market and your changing needs, there’s plenty to consider. However, one thing is clear: trying to perfectly time the market isn’t a reliable strategy.

Here’s why experts agree that time in the market matters more than timing the market.

Why Buying Sooner Can Pay Off

If you’re ready to buy and your finances are in order, purchasing a home now can offer long-term benefits. According to Bankrate,

“No matter which way the real estate market is leaning, buying now means you can start building equity immediately.”

Equity is one of the biggest financial advantages of homeownership, and the sooner you buy, the sooner you start building it.

The Numbers: Why Waiting Could Cost You

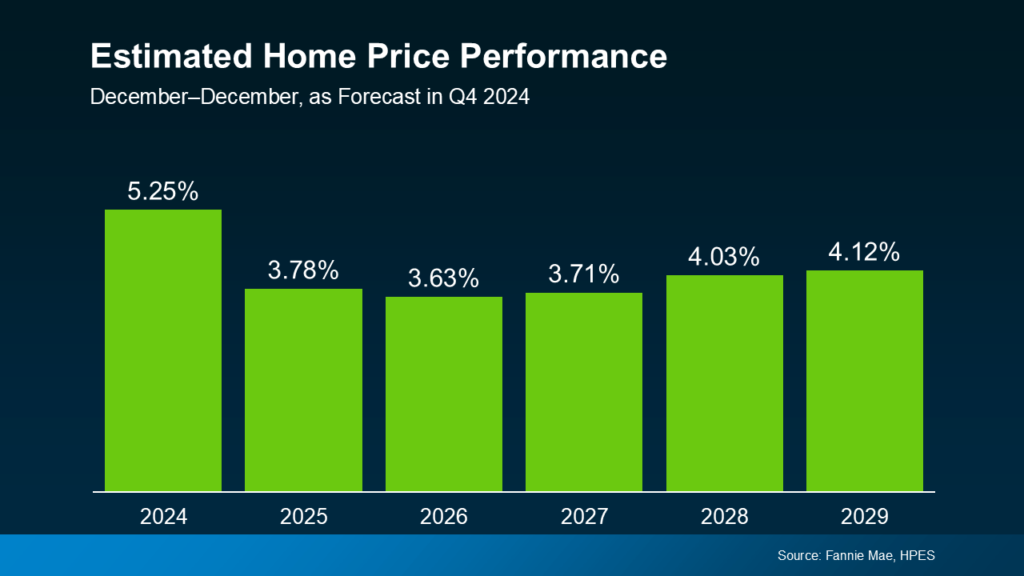

Each quarter, Fannie Mae releases the Home Price Expectations Survey (HPES), gathering insights from over 100 economists, real estate professionals, and market strategists. The latest data shows that while home price growth is slowing to a more typical pace, prices are still expected to rise through at least 2029. (see below)

Let’s put that into perspective. Imagine buying a $400,000 home in early 2025. Based on the latest projections, your home could gain over $83,000 in equity by 2030. That’s wealth you’re building just by owning a home.

Overcoming Today’s Market Challenges

Yes, today’s market has challenges, from higher interest rates to limited inventory. But there are creative solutions to help make homeownership possible:

- Explore different neighborhoods and determine what updates you’re willing to do (if any)

- Consider financing options, and maximize your sale proceeds towards your new home

- Work with an agent that can help you proactively look and come up with creative offer strategies

The Bottom Line: Timing Isn’t Everything

If you’re debating whether to buy a home now or later, remember: it’s not about perfectly timing the market—it’s about spending time in the market. The longer you wait, the more you might miss out on potential equity growth. Especially as home prices continue to increase year over year.

Let’s connect to explore your options and create a plan to help you coordinate your home sale and new purchase in Omaha, no matter the challenges. Whether it’s this month or later in the year, starting the conversation now can set you up for success. Contact me today and let’s discuss your situation!